Table of Content

Under the scheme, you can get subsidy of up to Rs.2.67 lakh. The subsidy is available to individuals earning up to Rs.18 lakh per year. I took home loan from MAGMA HOUSING FINANCE on 6 months back , the loan duration of 20 years for the amount of 18L. From LIC, they offered a home loan and the loan amount was Rs. 27,00,000.

This variant of SBI home loan is very useful for young salaried between years. The Flexipay calculator allows you to calculate the EMI division that you pay during the home loan tenure. What are the eligibility criteria for SBI's balance transfer of home loan or top-up loan? The eligibility criteria for SBI’s balance transfer of home loans or top-up loans are the same as that of regular loans – the applicant should be an Indian citizen/NRI and be between 18 and 70 years of age. State Bank of India’s home loan eligibility depends on a number of factors such as the age of the applicant, credit score, and income or salary. A personal loan calculator can help you evaluate the EMI amount you need to pay every month towards the personal loan to refurbish or renovate your home.

MaxGain Home Loan Calculator

Please note Brokerage would not exceed the SEBI prescribed limit. Does SBI home loan take the salary of the spouse into consideration? If the spouse is the co-owner of the property that is being bought with the loan, or is a guarantor of the loan, then the salary of the spouse is taken into account when determining the loan amount.

When you take a personal loan to renovate your home, it has a fixed repayment loan duration, with monthly repayments known as EMI. On obtaining the loan, you would need to pay these equated monthly instalments or EMIs over the entire loan duration. On Wednesday, the country’s largest lender, State Bank of India raised the Benchmark Prime Lending Rate by 70 basis points (or 0.7 per cent) to 13.45 per cent. The loan repayment linked to BPLR would be costlier due to this. The bank has also raised the base rate by similar basis points to 8.7 per cent.

Corporate Accounts Group (CAG)

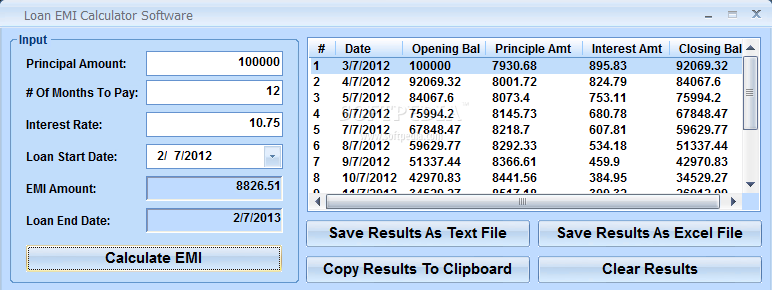

This process of calculating EMIs is known as amortization. For example, let’s consider you have availed a home loan of Rs. 60 Lakh at 9% (0.75% per month) rate of interest with tenure of 20 years . State Bank of India accepts co-applicants provided they have a regular source of income or salary with documents to be furnished as proof of salary or income. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon.

They have sanctioned the loan amount of 15L with tenure period of 15 years. Since I am going to buy a plot so taken this loan offer. If you are looking to repair/renovate/alter the structure of your existing property, home improvement/renovation loan is the product for you. These loans also come with longer loan repayment tenures and attractive interest rates. SBI allows you to repay the personal loan in equated monthly installments over 72 months.

Balance Transfer of Home Loan Calculator

State Bank of India offers attractive interest rates on home loans starting at 8.55% p.a.The loan tenure can be extended up to 30 years, ensuring a comfortable repayment period. The processing fee on these loans is 0.35% of the loan amount (Min. Rs.2,000; Max. Rs.10,000) plus applicable taxes. Women borrowers are also offered an interest concession of 0.05% on SBI Home Loans. No hidden charges and a full waiver of prepayment charges make them one of the most preferred housing loan products in the country. However, a risk premium will be paid based on the credit score. This indicates that for regular home loans, a borrower who has a credit score above 800 will now pay a minimum rate of 7.55%.

In recent years, home loans have seen a considerable rise, one of the primary factors for which is the Pradhan Mantri Awas Yojana . Under the Credit Linked Subsidy Scheme of this Yojana, first-time and eligible borrowers can avail subsidies on their home loan interest rate. How will I know if my eligibility criteria have been met for SBI home loans? How can I increase my chances of being eligible for SBI's home loan?

Explore your dream house from a bouquet of exclusive products designed for each customer segment. It can help you determine the real cost of making home improvements and avoiding costly and disruptive moves. Assuming Mr. A takes a loan of Rs 2.5 lakhs at an interest rate of 10.4% for five years. According to the formula, the EMI for this loan amount will be Rs 5361. We'll ensure you're the very first to know the moment rates change.

A personal loan calculator can be an excellent way to know how much you will need to pay as EMI every month towards your personal loan for home renovations. For SBI balance transfer loans, is the pre-payment penalty also included? Yes, the prepayment penalty will be funded in the SBI balance transfer loans but the total loan amount will be subject to the eligibility as per the relevant SBI home loan scheme.

Copy of Form 16 for last 2 years or copy of IT Returns for last 2 financial years, acknowledged by IT Dept. Enter interest rate that the lender will charge on the loan. Shows the results based on the fractional rate of interest. It enables you to choose the correct tenor to ensure the monthly installments are easily manageable. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans.

Nothing contained in the articles should be construed as business, legal, tax, accounting, investment or other advice or as an advertisement or promotion of any project or developer or locality. ICICIdirect.com is a part of ICICI Securities and offers retail trading and investment services. It shows you the exact figure you will have to repay every month over the loan tenure. All you need to do is enter the principal amount, the rate of interest and the loan and duration or tenure to instantly get an indicative amount of the EMI you need to pay every month. Yes, SBI does give pre-approved home loans for which you can contact the bank for more details.

Depending on their credit score customers may be asked to pay an interest of up to 9.40%. SBI Flexipay Home loan provides an eligibility for a greater loan. It offers customer the flexibility to pay only interest during initial 3-5 years and thereafter in flexible EMIs.

Individuals must have a good CIBIL score to avail the offer. A personal loan calculator is a critical tool that can help you calculate your home renovation loan based on crucial data such as the amount you borrow, the interest rate applicable on the loan, and the loan tenure. A personal loan calculator can help you plan your finances and work on an amount that does not affect your financial health or credit score. SBI Surakhsha State Bank of India's SBI Suraksha is a life insurance policy linked to the bank's home loan. The premium of this life insurance policy is paid by the bank.

No comments:

Post a Comment